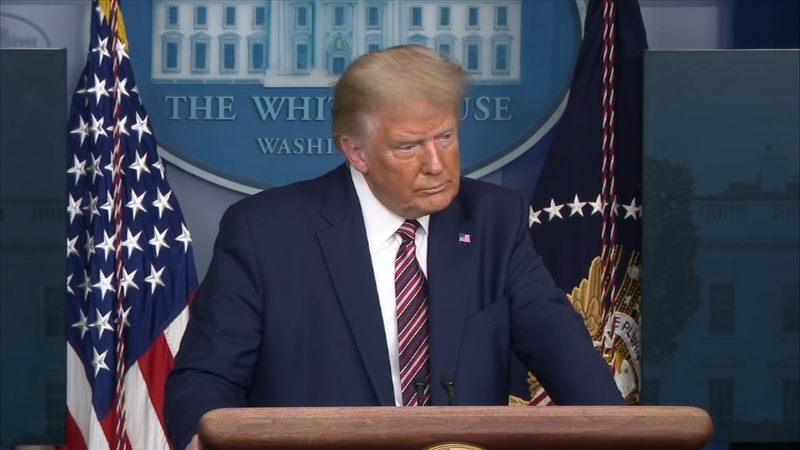

One of the biggest secrets in American politics — what’s in the tax returns that President Donald Trump has refused to release for so long — has at last been revealed, by the New York Times.

Times journalists Russ Buettner, Susanne Craig, and Mike McIntire obtained “tax-return data extending over more than two decades” related to the president, and have revealed their findings in a bombshell news report. (They are not posting the documents themselves, to avoid jeopardizing their sources.)

For years, the political world has speculated on what Trump was trying to hide by holding back his returns, and by falsely claiming that he can’t release them until the IRS (Internal Revenue Service) finishes an extended audit. Was it that he paid no income taxes at all in some years? Was it that he was far less successful a businessman than he let on? Was he claiming legally dubious deductions?

The answer, it turns out, is all of the above.

The Times story makes clear the supposedly wealthy president often paid no income taxes while his businesses regularly lost vast sums of money, and he himself was on the hook for increasing sums in loans. All of that is politically damaging enough to Trump’s image, and likely a sufficient reason to work hard to keep the tax returns secret.

But there’s likely another reason behind Trump’s reticence — because reporters would scour his returns for legally dubious claims, and put the pieces together to how he was trying to snooker the IRS.

That’s just what ended up happening here. For example, Buettner, Craig, and McIntire sussed out that mysterious write-offs for consulting fees on certain Trump projects matched the amounts of payments to Trump’s daughter Ivanka. And there’s far more in the Times’ excellent piece.

One major theme of the Times piece is that the IRS audit of Trump is extremely serious, and that he could end up owing the US government more than $100 million. So reporters’ scrutiny of his tax returns might not just be politically problematic for Trump — they could also be financially and legally problematic.

The tax returns reveal that Trump paid little taxes, that his businesses lost lots of money, and that he’s deeply in debt-none of which looks good politically

When Trump first ran for the Republican presidential nomination in 2016, he came under an enormous amount of criticism from his rivals for not releasing his tax returns, as past presidential nominees have. Initially, he promised that he would release them. But he kept making excuses, his main one being the false claim he could not yet release the returns because he is under audit.

So Trump’s tax returns became the white whale of his critics, with everyone from reporters to House Democrats to New York state prosecutors trying to get ahold of them.

After more than four years, Buettner, Craig, and McIntire of the Times got the goods.

Their story reveals the following: Trump did indeed pay zero in income taxes from 2011 to 2014, and a paltry $750 in 2016 and 2017. He pulled this off by claiming that his businesses lost massive amounts of money. He has $421 million in debt due in the next few years, and he could owe $100 million more to the US government if he loses his audit battle with the IRS.

There are ample political reasons here for Trump to have been so reluctant to release the returns.

For one, there’s the fact that he paid so little income tax, which will look bad from the perspective of many Americans who paid much more in taxes than he has. You might wonder why Trump would care about this given his longstanding ability to wriggle free of political scandals — but that ability wasn’t so clear in 2016, when he first started holding back the returns. Additionally, Trump’s first campaign came just a few years after Sen. Mitt Romney was dogged by then-Senator Harry Reid’s false allegation that Romney paid no taxes for 10 years. The political conventional wisdom was that a wealthy candidate having paid little to nothing in taxes would be punished electorally.

But the specific reason Trump paid no taxes is embarrassing — because his businesses lost tons of money. (At least, that’s what he claims; keep in mind that the tax return information is his representation of his businesses to the IRS.)

To be clear, some parts of Trump’s business really do make money — for instance, The Apprentice sent cash pouring in, and Trump Tower is profitable. But Trump avoids paying taxes on these profits because he’s claimed such massive losses from other parts of his business empire.

Trump may also have held back the returns to avoid legal and financial jeopardy

The other probable reason Trump was reluctant to release the returns is that there’s clearly some legally questionable stuff in there.

For instance, the records obtained by Buettner, Craig, and McIntire show that Trump wrote off $26 million in supposed consulting fees as a business expense between 2011 and 2018. But the reporters took the added step of uncovering where some of that money was going — and they figured out that some of those write-offs matched payments to Trump’s daughter Ivanka, as revealed on her own financial disclosure forms.

Ivanka was an executive vice president of the Trump Organization, not some outside consultant. And sources told the Times that there were no outside consultants involved in certain projects for which Trump’s businesses wrote off consulting fees.

The Times story also mentions other questionable practices — Trump dubbed a Westchester, New York, mansion an “investment property” so he could write off property taxes on it, but his son Eric Trump called it “our compound.” The Trump Organization also wrote off Donald Trump Jr.’s legal fees for the lawyer who represented him in the Russia investigation.

This is probably just scratching the surface — the Times reporters say they have more stories coming. But the larger point is that Trump has a history of questionable tax practices, is facing an audit where he has a lot on the line, and having reporters closely scrutinize his tax returns is only a problem for him.

*The writer covers the White House, Congress, elections, and really anything about politics that piques his interest.

(Vox)

September 28, 2020

The viewpoints expressed by the authors do not necessarily reflect the opinions, viewpoints and editorial policies of Aequitas Review.