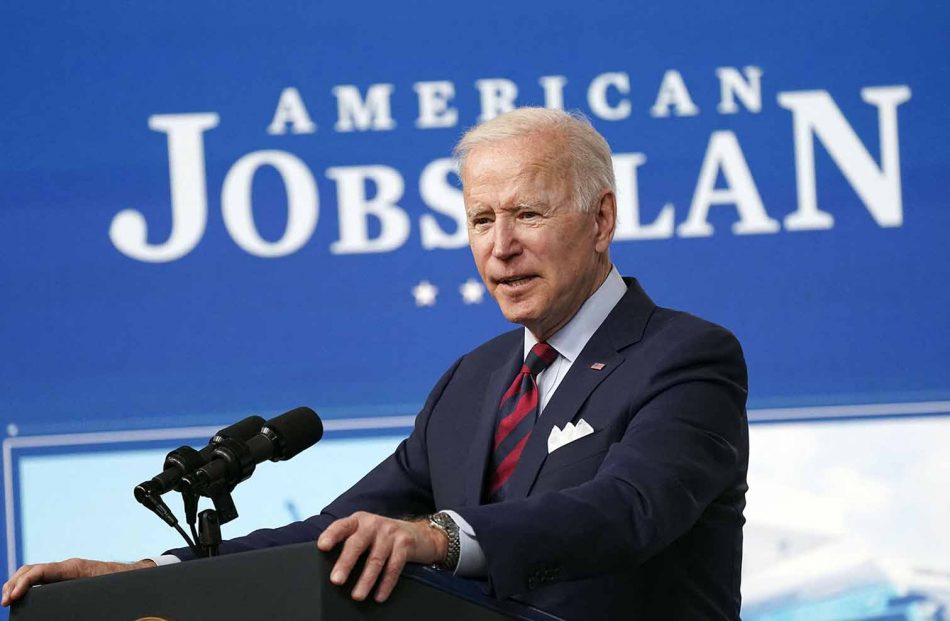

The US House Democrats are hoping to pass President Joe Biden’s infrastructure bill by July 4, because of course they are. The Biden team is making a point of wrapping its economic initiatives firmly in the flag. First came the American Rescue Plan; now we have the American Jobs Plan paid for by the Made in America Tax Plan.

And why not? Trumpism was, in part, about the appeal of economic nationalism, so it makes sense to try to snatch away that appeal on behalf of good policy. It’s also a pre-emptive defense against the inevitable Republican attacks; Donald Trump, who still exists, has already denounced Biden’s plan to raise corporate taxes as a “classic globalist betrayal.” No, he isn’t making sense.

There is, however, more going on here than marketing. Bidenomics consists, roughly speaking, of large-scale public investment paid for with highly progressive taxation. And both of these things are as American as apple pie.

The Biden administration infrastructure fact sheet alludes to part of that history, declaring that the plan “will invest in America in a way we have not invested since we built the interstate highways and won the space race.” Indeed, one way to think about the Biden program is that it’s an attempt to bring back the Dwight stuff — that is, in fiscal terms, it would represent a partial return to the Eisenhower era, when we had much higher government investment as a share of gross domestic product than we do now, and also much higher tax rates on both high-income individuals and corporations.

The era of big government investment and high taxes on the rich coincided, not incidentally, with the US economy’s greatest generation — the postwar decades of rapidly rising living standards.

But the story of public investment and progressive taxation in America goes back much further than the ‘50s.

We’ve relied on government infrastructure investment to jump-start economic growth ever since the construction of the Erie Canal between 1818 and 1825. Unlike the privately owned canals that had proliferated in 18th-century Britain, the Erie Canal was built by the government of New York state, at a cost of $7 million. This may not sound like a lot, but the economy was vastly smaller then, and prices much lower, too. As a share of state GDP, the canal was probably the equivalent of a $1 trillion national project today.

And a big public role in infrastructure continued down the generations. Land grants were used to promote railway construction and higher education. Teddy Roosevelt built the Panama Canal. FDR brought electricity to rural areas. Eisenhower built the highway network.

So when Republicans denounce the American Jobs Plan as an “out-of-control socialist spending spree,” remember, large-scale public investment is the American way.

We can say much the same thing about Biden’s tax proposals.

Actually, given extremely low borrowing costs, it’s not obvious that we would even need a tax hike if infrastructure spending were the end of the story. But we will need more revenue to pay for the whole Biden program, which everyone expects will eventually include another round of spending targeted on families. So it makes sense to tie tax hikes to the jobs plan; polling suggests that paying for public investment with taxes on corporations and the rich increases support for an infrastructure plan, and that something along the lines of the Biden proposals will command very high public approval.

Republicans will no doubt denounce the idea of taxing the rich as un-American class warfare. In reality, however, such taxation is another long tradition in this country. As Thomas Piketty, the inequality scholar likes to put it, America basically invented progressive taxation.

What about Trump’s assertion that raising corporate taxes is a form of sinister globalism? The claim here is that reversing some of the 2017 tax cuts would drive investment and jobs overseas, a claim that might have some credibility if that cut had in fact induced multinational corporations to bring investment and jobs back home. But it didn’t.

In practice, the Trump corporate tax cut amounted to a giveaway to shareholders, with no visible benefits to the broader economy. And since we’re talking globalism, it’s worth pointing out that foreigners own about 40% of US stocks.

Wait, there’s more. There’s a reason Biden’s people put “Made in America” in the title of their tax plan. They believe that the Trump tax cuts weren’t just a huge money-loser, they were badly designed in ways that actually encouraged corporations to invest abroad, and that they can do better. I’ll try to get into those weeds in another column; what seems clear is that the Biden tax plan is unlikely to cause job losses and could lead to significant job gains.

There will and should be extensive debate over the details of Biden’s spend-and-tax plan over the next few months. In its broad outline, however, the plan represents a turn away from the free-market extremism that has ruled US policy in recent years, back to an older tradition — the tradition that prevailed during America’s years of greatest economic success.

*Paul Krugman is one of America’s foremost public intellectuals and academics. He won the Nobel Prize for Economics in 2008 for his contributions to New Trade Theory and New Economic Geography.

(New York Times)

April 11, 2021

The viewpoints expressed by the authors do not necessarily reflect the opinions, viewpoints and editorial policies of Aequitas Review.